Goldman Sachs Group Inc. once again warns buyers against falling, who dive into stocks again and again: the December volatility breakthrough has every chance of being realized, and risk indicators do not yet give a clear buy signal.

Is it worth redeeming the failure? Experts don't think so.

So, according to Christian Muller-Glissmann, managing director for portfolio strategy and asset allocation, the hawkish policy of the Federal Reserve System, which is gaining momentum, as well as the spread of the omicron option, will continue to create all sorts of trade problems in the short term.

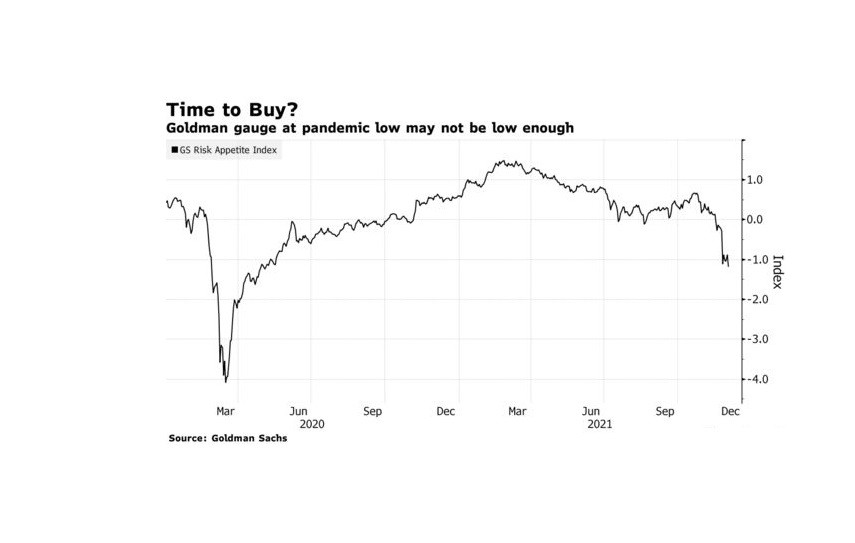

After a wave of sales that brought down everything from major technologies to bitcoin, the indicator of investor interest in risky assets of Goldman Sachs dropped below zero, but, according to the firm, this is far from the limit.

The stock has fluctuated sharply since the appearance of the omicron option triggered a risky flight on November 26. The following Monday, the S&P 500 recovered, only for Powell's reversal to trigger the biggest two-day drop in more than a year. Hedge funds have reduced exposure to stocks at the fastest pace in 20 months. And once-reliable retail buyers have seen their brokerage accounts go bankrupt due to spending cryptocurrencies, SPAC, and speculative technology stocks.

On Monday, buyers appeared, pushing stocks up and Treasury bonds down, but the fall of the S&P 500 index at the end of the session kept the VIX above 27. Stock fluctuations last week caused the volatility curve, which usually has an upward slope, to turn around, signaling that uncertainty in the near future is higher than what will happen in a few months. The April contract is hovering 0.2 points above the May contract, which, in turn, is trading 0.2 points above the contract expiring in June.

Although the inversion of the time structure of the VIX is not as pronounced as on Friday, the so-called backwardation of the curve shows concern about everything from the new COVID-19 variant to the hawkish tilt of the Fed.

"Without any point of view on a more perfect macro, you would like RAI to be closer to -2 before adding risks," Muller-Glissmann commented on the figures in an interview. "A drop below or near -2 may create a very good opportunity for a repeat risk and a more pro-cyclical position, especially if growth stabilizes after omicron."

His caution runs counter to the large turnover of risky assets this week, which indicates that the new strain will not be as dangerous and deadly as expected and will not derail the economic recovery.

Indeed, markets have regained optimism, buying back most of Monday's dip. After Jerome Powell's hawkish turn last week, Federal Reserve officials kept their mouths shut ahead of the next central bank meeting, leaving these few days without any important data or comments to change the mood. And players will have to wait until Friday to get the latest inflation data.

This forces investors to carefully analyze other indicators to determine whether the wave of turbulence that led to the movement of the S&P 500 by at least 1% in six of the last seven sessions has exhausted itself.

Meanwhile, the Deutsche Bank AG indicator also signals that risky assets may be approaching a minimum.

Bankers' warnings make sense because sentiment in the volatility markets is fragile. Usually, investors pay to insure against wilder fluctuations than what they have already experienced. The flow of turbulence last week was the worst in a year: the S&P 500 index recorded movements up or down by at least 1% for five consecutive days until Friday. And this is far from the first session of wild fluctuations for the index – such metamorphoses began in October.

At 27, the VIX is still seven points above the average for the year, and futures contracts for the coming months are higher than in the following months, which is a signal that investors expect turbulence to persist in the short term.

According to Nicholas Kolas, co-founder of DataTrek Research, the mad race will continue, possibly for the rest of the year, as investors evaluate the market, which has already grown by more than 20%. He recommends waiting until the VIX reaches at least 36, but preferably 44, before buying stocks. Friday's surge of the VIX to 35 and a close at 31 does not indicate a bottom, he wrote in a note on Sunday.

"We don't want these observations to scare, as we maintain long-term positive dynamics about US stocks, but we have no doubt that bumpy roads await the markets this month," he said. "The story is just too clear about how December is going when we've already seen great results," he said. "Investors face both Fed policy and short-term profit uncertainty."

Nevertheless, Deutsche Bank's cross-asset dynamics indicator is consistently negative and is already close to historical lows.

"Latitude is now approaching where it usually changes, so we expect some asset classes to find their bottom here," an employee at Deutsche Bank said in an interview. "Repairs should be in the short term, it should happen in the next three to four weeks."

Expert Andrew Thrasher suggested that inversion could be good news for bulls in the stock market next year.

"The premium that is invested in volatility futures mainly relates to first-month contracts, as we do not see the VIX futures curve returning to contango from April to June. This suggests that the market does not take into account the long-term increase in sustained volatility," he said.

He also says that the pullback of the VIX on Monday may be a sign that the market is ready to resume growth before the end of the year.

"Internal market failure is still a concern, but the strength of large injections prevented too much weakness of small individual stocks from being reflected in the general indices," Thrasher said.

Still, an inverted VIX often means that the turmoil continues, and investors who thought last Monday's rebound marked the end simply don't know how much everyone is walking on the edge. There are reasons to remain vigilant.

"On Friday, VIX futures went in the opposite direction - this is a sign that the market is experiencing some pressure," Mark Sebastian said in an interview. "It happened today, but the VIX futures curve is still very flat, which is worrying."