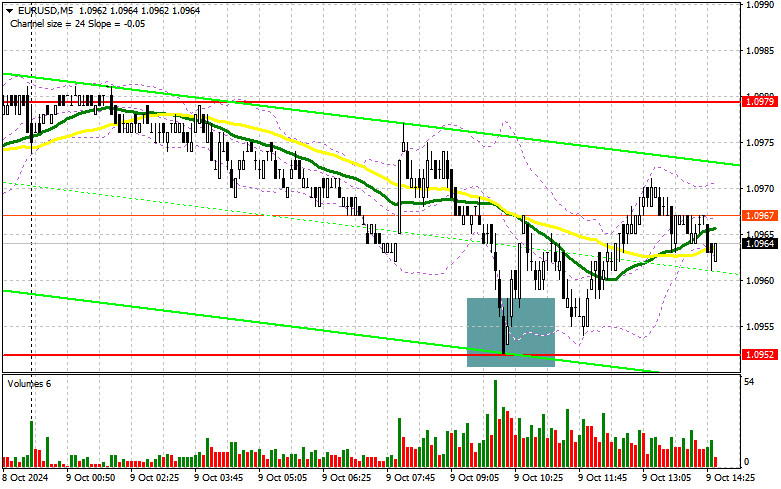

In my morning forecast, I focused on the 1.0952 level and planned to make market entry decisions based on it. Let us look at the 5-minute chart and analyze what happened. A decline and the formation of a false breakout around 1.0952 offered a favorable entry point for buying the euro, leading to a rise of almost 20 points. The technical outlook for the second half of the day remains unchanged.

To open long positions on EUR/USD:

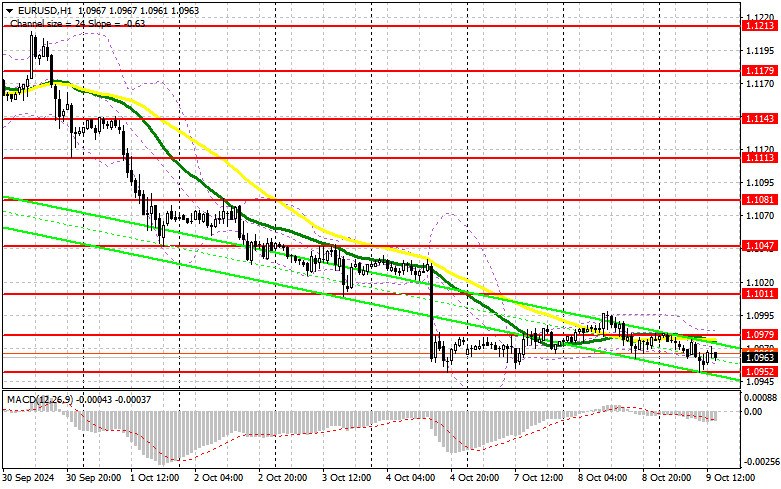

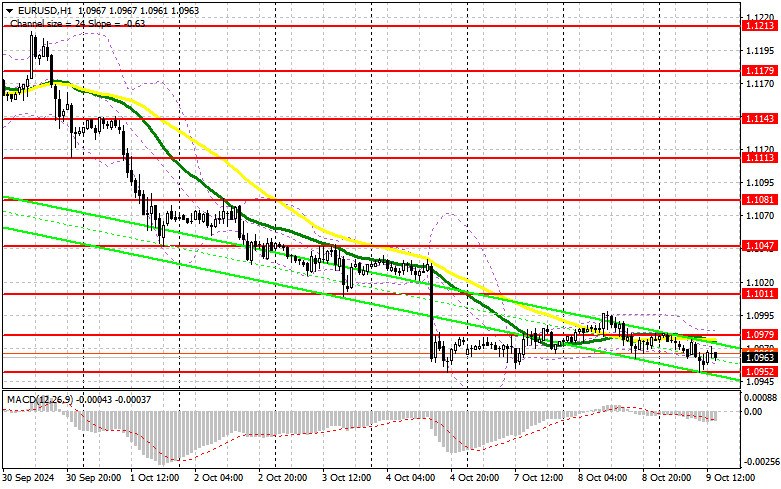

The lack of significant data and volatility is expected. It appears that there is no rush to buy euros at the current levels, as a large player would likely have driven the pair higher by now. Attempts to halt the euro's decline occurred around the weekly low, but enthusiasm quickly faded. Numerous speeches from FOMC members are scheduled, making it impractical to list them all. Similar to the previous day, a cautious tone from policymakers could help the dollar break the weekly low against the euro, so I will be very cautious with buying. My plan is to follow the morning scenario: a false breakout around 1.0952, similar to the one analyzed above, would be a suitable condition for increasing long positions, opening the way to 1.0979 and 1.1011. A breakout and retest of this range would confirm a good entry point for buying, aiming for a retest of 1.1047, allowing buyers to recover some losses from Friday's drop. The furthest target is 1.1081, where I will take profit. If EUR/USD continues to decline and there is no activity around 1.0952 in the second half of the day, which is more likely, pressure on the euro will persist. In that case, I will enter after a false breakout around the next support level of 1.0919. I plan to open long positions on a rebound from 1.0884 with a target of a 30-35 point upward correction during the day.

To open short positions on EUR/USD:

It's clear that sellers intend to maintain market control, but a significant catalyst is needed for more active actions. If the euro rises in the second half of the day following the publication of the FOMC minutes, a false breakout around 1.0979 will provide a good entry point for new short positions, with a potential decline to the support at 1.0952, which serves as the weekly low. A breakout and consolidation below this range, followed by a retest from the bottom up, would offer another suitable selling opportunity, targeting the 1.0916 level, further strengthening the bearish market. I expect to see more bullish activity only at this level. The furthest target will be the 1.0884 level, where I will take profit. If EUR/USD rises in the second half of the day and sellers are absent at 1.0979, buyers might gain an opportunity for a notable strengthening of the pair. In that case, I will postpone selling until testing the next resistance at 1.1011. I will sell there only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.1047 with a target of a 30-35 point downward correction.

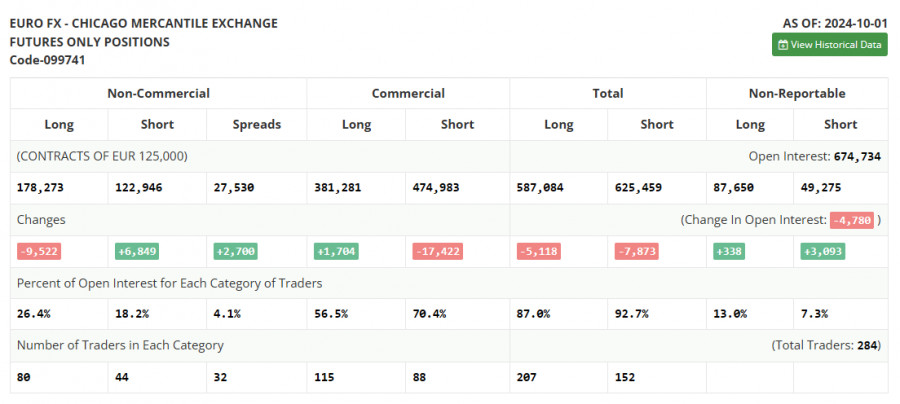

In the COT (Commitment of Traders) report for October 1, there was a slight increase in short positions and a sharp reduction in long positions, leading to a shift in market balance toward sellers. Clearly, the recent better-than-expected U.S. labor market data are now key to the Federal Reserve's future decisions, which are expected to be more cautious and less abrupt. The central bank will likely adopt a more cautious stance on future rate cuts, which should have a positive impact on the U.S. dollar and its strength. However, this does not negate the medium-term upward trend for the pair, and the lower it falls, the more attractive it becomes for buying. The COT report shows that long non-commercial positions decreased by 9,522 to 178,273, while short non-commercial positions increased by 6,849 to 122,946. As a result, the gap between long and short positions widened by 2,700.

Indicator signals:

Moving Averages:

Trading is conducted around the 30 and 50-day moving averages, indicating market uncertainty.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.0952 will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA with a period of 12, Slow EMA with a period of 26, and SMA with a period of 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.