Over the past two weeks, Bitcoin has made a powerful downward move, hitting a several-month low near the $38.5k level. Subsequently, the asset managed to recover above the $40k level and further disrupt the structure of the downward trend, reaching the $42k level. As of February 5, the cryptocurrency is consolidating within the $42k–$43k range with minimal price impulses and low trading volumes. The main reason for this is the overall decrease in investment activity against the bleak results of the Federal Reserve's monetary policy.

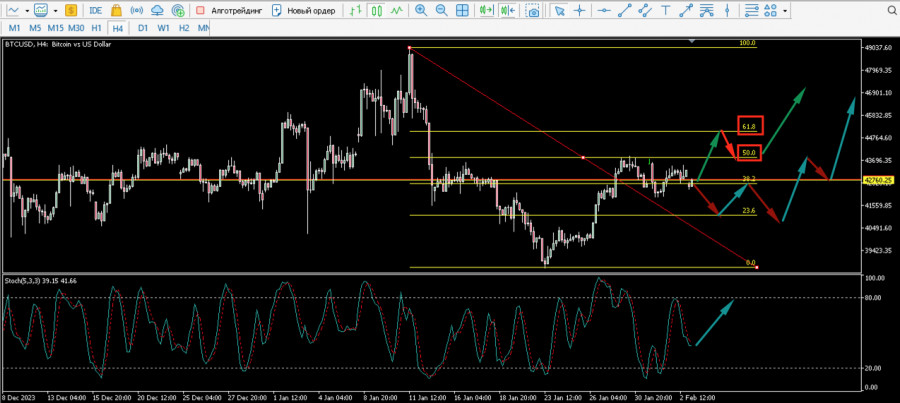

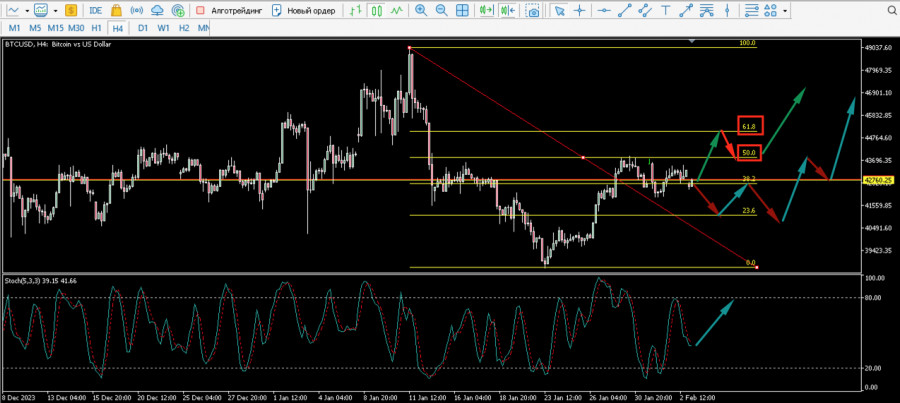

Despite local pessimism, Bitcoin is at a crossroads, where excluding consolidation movement, two possible scenarios for the cryptocurrency's price movement remain. Considering the end of a highly volatile week filled with important macroeconomic reports, technical analysis comes to the forefront again. Bitcoin has the chance to continue its upward movement with the prospect of updating the local high or undergo a correction below the $38k level.

Fundamental Background

Macroeconomic factors, specifically the Federal Reserve meeting and consumer sentiment indicators, were published last week and formed an understanding among investors that the interest rate will not be lowered at the March meeting. According to CME Fedwatch data, investors are confident in maintaining the current rate level in March, but positive expectations regarding the May Federal Reserve meeting are already being formed.

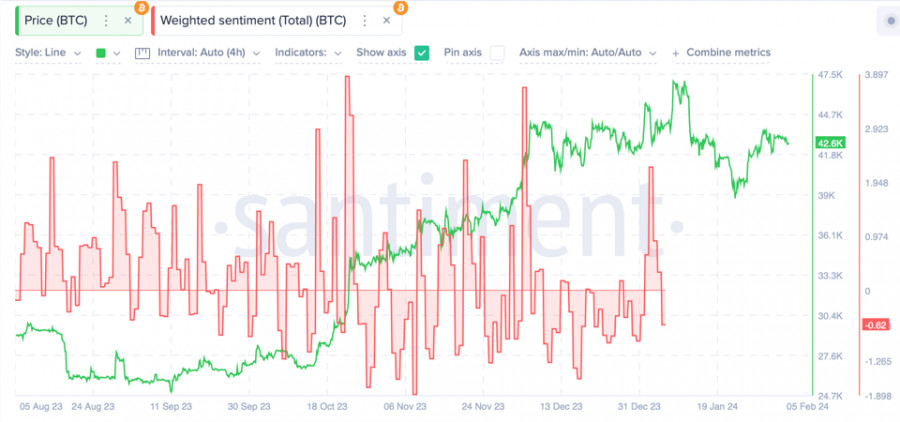

However, the main macroeconomic indicator of the current trading week will be the publication of the labor market report, which has limited impact on Bitcoin quotes. Considering the minimal influence of external factors, specific scenarios of possible cryptocurrency price movements should be considered. Given the decline in bullish sentiment, the most likely scenario for the BTC/USD price movement is the bearish scenario.

Bearish Scenario

As of February 5, Bitcoin is trading near the $42.6k level, unable to break the resistance level at the $43k mark. According to the Fibonacci system, BTC/USD has closely approached the 0.5 Fibonacci level. This indicates that Bitcoin has room for further upward movement to the $45k level, where the 0.618 Fibonacci level passes, which is often the final target of a correction movement. On the 4H chart, the MACD indicator shows that BTC/USD is within a downward trend, strengthening bearish positions.

On the 1D chart, the stochastic oscillator is in the overbought zone, which will ultimately lead to a longer-term decline. Several factors indicate that Bitcoin will resume its decline after consolidation, with the main target being the $38.5k–$39.2k level. Breaking through this level completes the formation of the "Head and Shoulders" technical analysis pattern, with the potential for a downward movement to $28k. This scenario is canceled if Bitcoin's quotes fully break and consolidate above the $45.5k level.

Bullish Scenario

Now, let's move on to the bullish scenario, the essence of which lies in updating the local price high near the $50k level. It is worth considering two options for bullish movement: a direct one and a corrective one. Considering the pessimistic sentiments in the cryptocurrency market, as well as macroeconomic and geopolitical uncertainty, Bitcoin will resume its growth through a decline and a retest of the $40k level. In this scenario, breaking the $38.5k–$39k level is allowed, but not a full breakthrough of the round psychological level.

Subsequently, BTC/USD will resume its upward movement, advancing through the levels of $42.5k, $43.8k, and $45k. It is precisely the consolidation above $40.5k, the 0.618 Fibonacci level, that will put an end to the bearish idea for BTC in the medium-term perspective. The direct bullish scenario involves the cryptocurrency resuming a bullish rally from its current positions. However, as of February 5, such a development looks unlikely due to low buying activity and a negative news background.

Conclusion

Bitcoin starts the current week in advantageous positions, both for resuming the downward movement due to unsuccessful retests of the 0.5 Fibonacci level and for confidently recovering above $40k. Stablecoin volumes and increasing purchases from "whales" provide hope for a resumption of the upward movement from current positions. However, considering the absence of significant economic events and technical signals, a decline in BTC should be expected in the new trading week.