The EUR/USD currency pair continued its upward movement on Wednesday without any obstacles. What else can it do when Trump is making speeches every day, and every one of his addresses contains the same themes—threats, pressure, blackmail, insults, and coercion? We have been repeating the same thing for about a month now: the biggest enemy of the U.S. dollar is Donald Trump. We did not expect that, at a certain point, the American currency would start collapsing while ignoring all other reports and events. But at the beginning of March, that is precisely what happened. Essentially, the U.S. president is the only factor driving movements in the foreign exchange market right now.

As a result, all our expectations of the euro falling below price parity and the pound dropping to 1.1800 have been put on hold indefinitely. No one could have predicted such a turn of events. It would have been one thing if Trump had negotiated with all the countries and then started cautiously introducing tariffs while explaining his reasons. But instead, he imposed tariffs against Mexico, Canada, and China, and now he intends to sanction India, China, the EU, and the UK without any discussions.

Remember Trump's first term? As it turns out, everything that happened back then was just a prelude. The actual consequences are coming in his second term. How should the market react when Trump destroys trade and business ties with all his major trading partners? After all, tariffs always lead to retaliatory tariffs. Canada has already imposed tariffs on $30 billion worth of goods and has promised additional tariffs on over $100 billion. China immediately introduced proportional tariffs and announced that it was prepared for any trade war. Mexico has not stood aside either. The only country that has made concessions is Colombia. All the other countries on Trump's "blacklist" have realized that the more they comply with the U.S. president, the more he will blackmail, pressure, and "strip them down."

What's interesting is that today, many analysts stated that the dollar is falling because of Trump. We pointed this out as early as Monday since this week's macroeconomic background did not suggest such a sharp decline in the American currency. Neither the inflation report from the EU, business activity indices, or the unemployment rate showed figures that could justify a 350-pip drop in the dollar over three days. It is always easy to explain any movement after the fact. Even without apparent reasons, they can always be found or invented. The dollar's collapse is ongoing, and we wouldn't even attempt to predict where or when it will end. The macroeconomic and fundamental background no longer matters—right now, the market is trading based on Trump.

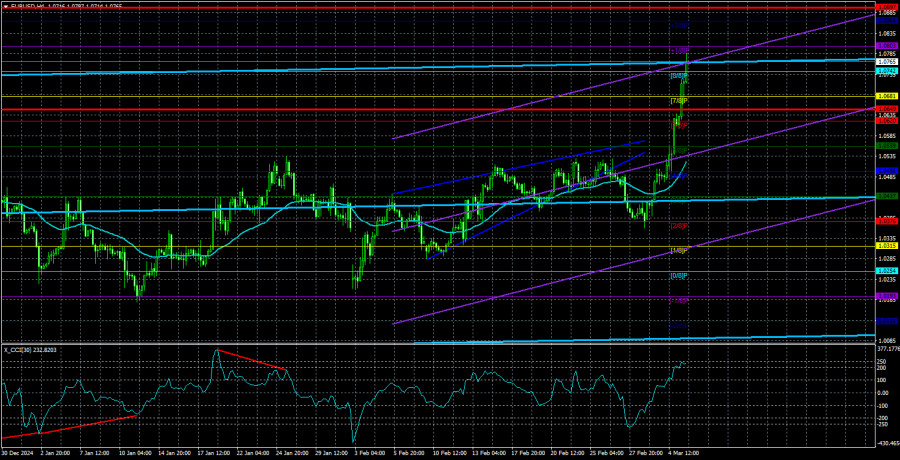

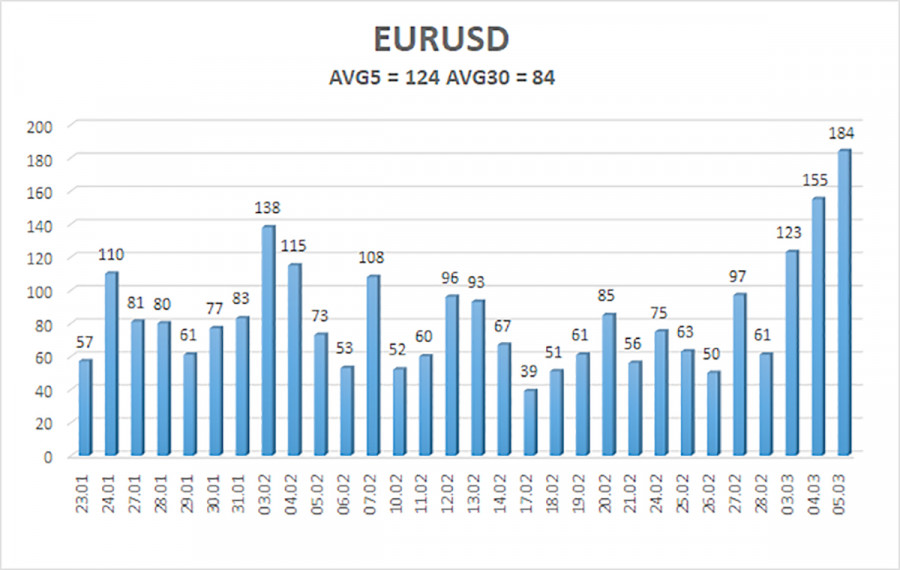

The average volatility of the EUR/USD currency pair over the past five trading days as of March 6 is 124 pips, which is classified as "high." We expect the pair to move between the levels of 1.0649 and 1.0897 on Thursday. The long-term regression channel has turned sideways, but the global downtrend will remain in place even if it turns upward. The CCI indicator has again entered the oversold area, signaling another upward correction.

Nearest Support Levels:

S1 – 1.0742

S2 – 1.0681

S3 – 1.0620

Nearest Resistance Levels:

R1 – 1.0803

R2 – 1.0864

Trading Recommendations:

The EUR/USD pair has broken out of the sideways channel and continues its rapid growth. Over the past few months, we have repeatedly stated that we expect the euro to decline in the medium term, and at this point, nothing has changed. The dollar still has no reason for a medium-term decline—except for Donald Trump. Short positions remain much more attractive, with initial targets at 1.0315 and 1.0254, but a new consolidation below the moving average is needed. If you trade based purely on technical analysis, long positions can be considered if the price is above the moving average, with targets at 1.0803 and 1.0864. Any upward movement is still classified as a correction on the daily timeframe.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.