The EUR/USD currency pair began to recover much of the ground it lost on Monday during Tuesday's session, as expected. On Monday, the U.S. dollar experienced a sharp decline due to the inauguration of Donald Trump and the market's reaction to his statements and plans. However, there were no concrete reasons for the dollar's drop. As we predicted, the dollar regained most of its lost positions by Tuesday.

It's important to note that there are still no reasons to expect a medium-term decline in the dollar. However, a correction is developing on the daily timeframe, which may need to be significant—around 500 to 600 pips. As a result, the euro may continue to rise from its current levels despite lacking fundamental or macroeconomic support for such a rise. Nonetheless, the overall downtrend remains intact, indicating that the outlook still favors a decline in the euro.

Donald Trump and his various initiatives are currently a major topic of discussion worldwide. On Monday, he made a series of statements that could impact nearly half of the world's countries. Among his boldest announcements were plans to impose tariffs on Mexico, Canada, the European Union, China, and BRICS countries. Each nation will have its own specific tariff plan, with different implementation timelines and tariff rates. Additionally, Trump demanded that EU nations increase their NATO spending and announced the United States' withdrawal from the World Health Organization (WHO). He also reiterated his desire to annex Greenland, take control of the Panama Canal, and rename the Gulf of Mexico as the "American Gulf."

Let's be honest—does anyone genuinely believe that even half of these plans will come to fruition? It seems that Trump has employed his favorite negotiation strategy: making sweeping ultimatums and then negotiating on U.S. terms. Trump, first and foremost, is a businessman. As such, he constantly seeks profits and will strive to boost U.S. revenues by any means necessary. However, it's important to note that Trump is also a gambler. Bluffing is another tool in his arsenal. While he may threaten Denmark over Greenland, if the plan falls through, it's no big deal to him—he'll simply say, "It was worth a try."

While changes under Trump are inevitable, they may not be as sweeping as he envisions. Trump makes many bold declarations, so it's likely that even he loses track of what he has said or promised previously. This is part of a larger strategy aimed at increasing profits, enhancing the U.S.'s geopolitical standing, and suppressing the growth of its competitors. However, one thing is certain: we can expect a steady stream of news from the White House during Trump's administration.

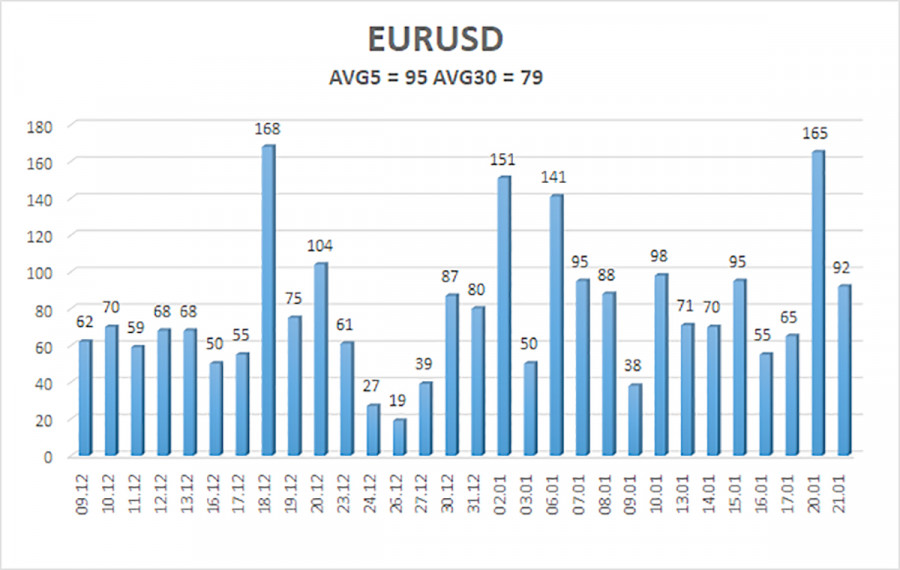

The average volatility of the EUR/USD currency pair over the last five trading days as of January 22 is 95 pips, classified as "high." On Wednesday, we expect the pair to move from 1.0324 to 1.0514. The higher linear regression channel remains directed downward, indicating that the global downtrend persists. The CCI indicator has entered the overbought zone, signaling the potential resumption of the downtrend. A bearish divergence may form, which could trigger a new decline.

Closest Support Levels:

- S1: 1.0376

- S2: 1.0315

- S3: 1.0254

Closest Resistance Levels:

- R1: 1.0437

- R2: 1.0498

- R3: 1.0559

Trading Recommendations:

The EUR/USD pair has entered a new phase of correction. For several months, we have maintained that the medium-term outlook indicates further declines for the euro. We continue to support the overall downward trend and do not believe it has come to an end. The Federal Reserve has paused its monetary policy easing, while the European Central Bank is accelerating its rate cuts. Therefore, there are no medium-term reasons for the dollar to weaken, except for purely technical corrections.

Short positions remain relevant, with targets set at 1.0193 and 1.0132. However, the current correction must conclude first. This correction could potentially end around the 1.0437 level. If you're trading based purely on technical analysis, long positions can be considered if the price settles above the moving average, with targets of 1.0437 and 1.0498. Nonetheless, any current upward movement should be viewed as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.