The GBP/USD currency pair experienced minimal volatility again on Friday, suggesting that the upward movement may be nearing its logical conclusion. Over the past two weeks, there has been a considerable amount of positive news regarding the British pound. The unemployment report did not indicate any new growth, while the wages report revealed an acceleration in growth. Additionally, the inflation report showed a sharp increase, and the GDP report exceeded expectations. Although the overall data concerning the British economy leaves much to be desired, even these figures are a cause for celebration for the British pound.

With wages and inflation accelerating, the Bank of England's stance has also slightly hardened. At the very least, experts and traders now expect less dovish action from the BoE in 2025. Previously, four interest rate cuts were anticipated, but now expectations have shifted to two or three. Thus, there has been good news for the pound, but they are not strong or fundamental enough to support further growth. It is worth noting that the past month's movement remains a correction within a broader downtrend.

Over the next five days, the UK will not have any truly significant events or data releases. There will be a few reports in the US, but none are expected to impact market participants significantly. The most important reports will be released on Thursday—Q4 GDP and durable goods orders. The GDP situation is clear: the US economy's growth rate slowed in the fourth quarter, though the second and third estimates may be revised upward. This is a normal occurrence for the US. As for the durable goods orders report, a 1.3% increase is expected after a poor December.

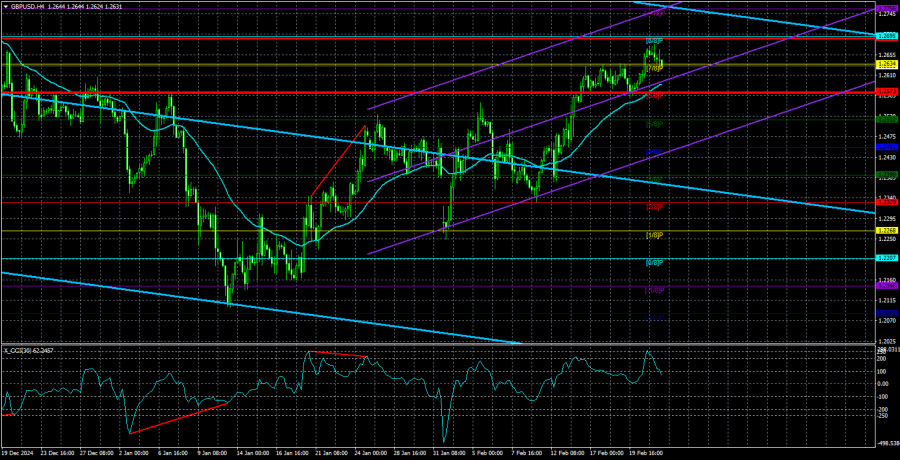

The PCE index will be published on Friday, which many experts consider highly important. However, we do not share this view. Overall, only the durable goods orders report may trigger some reaction from traders, while the rest of the events and reports are either secondary or merely revised estimates. This week, technical analysis will play a greater role, and after a reasonably substantial increase over the past month (+500 pips) and the CCI indicator being overbought, we expect a decline in the pair. This may not necessarily mark the end of the daily upward correction, but a slight pullback is needed at the very least. The pound has surged too quickly and sharply, and its divergence from the euro is evident.

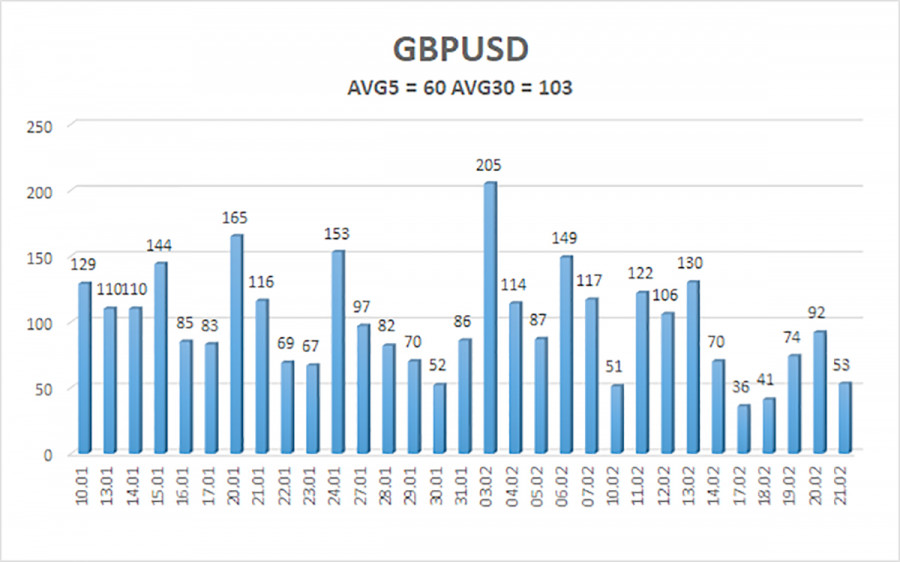

The average volatility of the GBP/USD pair over the last five trading days is 60 pips, which is considered "low" for this currency pair. Therefore, on Monday, February 24, we expect movement within the range of 1.2571 to 1.2691. The long-term regression channel remains downward, signaling a continuation of the bearish trend. The CCI indicator entered the overbought zone on Friday, suggesting a potential upcoming decline.

Nearest Support Levels:

S1 – 1.2634

S2 – 1.2573

S3 – 1.2512

Nearest Resistance Levels:

R1 – 1.2695

R2 – 1.2756

R3 – 1.2817

Trading Recommendations:

The GBP/USD currency pair maintains its medium-term downtrend. We still do not consider long positions; we view the current upward movement as a correction. If you trade purely on technical analysis, long positions are possible, with targets at 1.2695 and 1.2756 if the price remains above the moving average. However, short positions remain much more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will eventually end. For short positions, at the very least, a consolidation below the moving average is required. Of course, the best time to enter shorts would be at the end of the upward correction on the daily chart, but predicting exactly when that will happen is nearly impossible.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.